Sustainability | Free Full-Text | The Green Bonds Premium Puzzle: The Role of Issuer Characteristics and Third-Party Verification | HTML

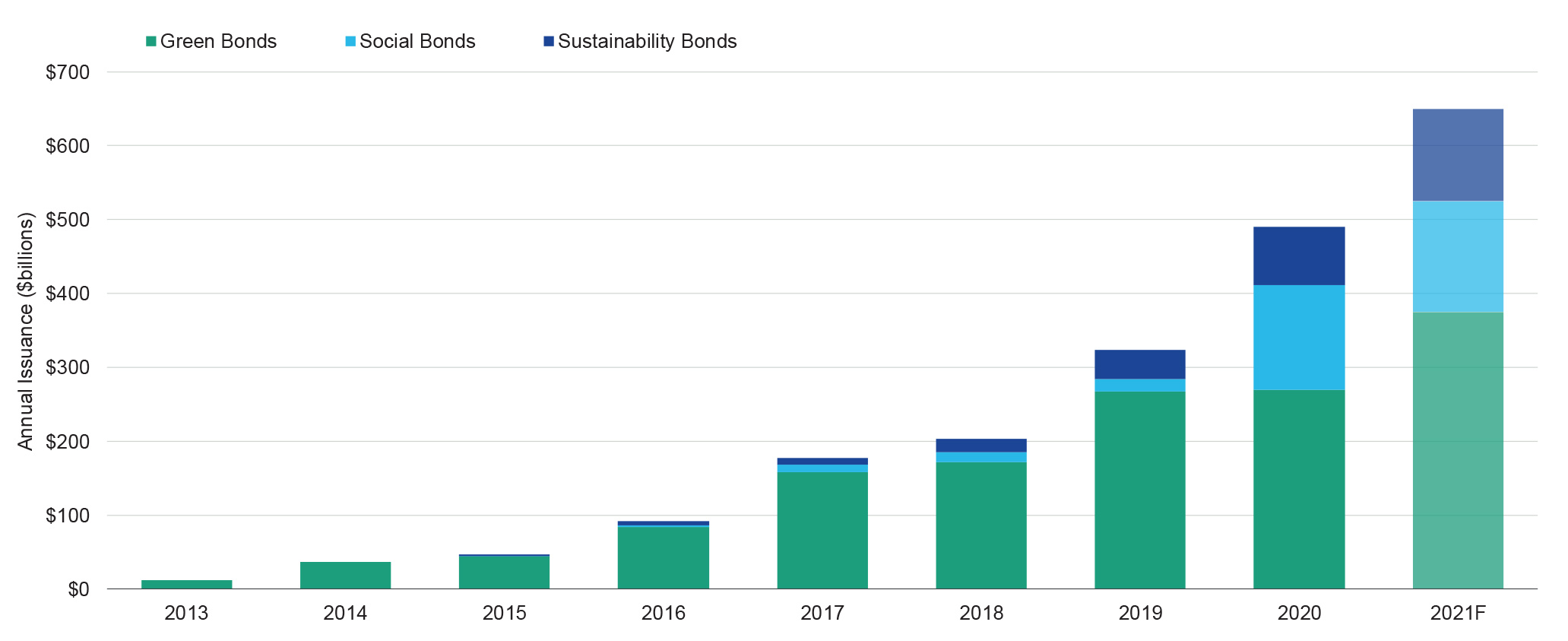

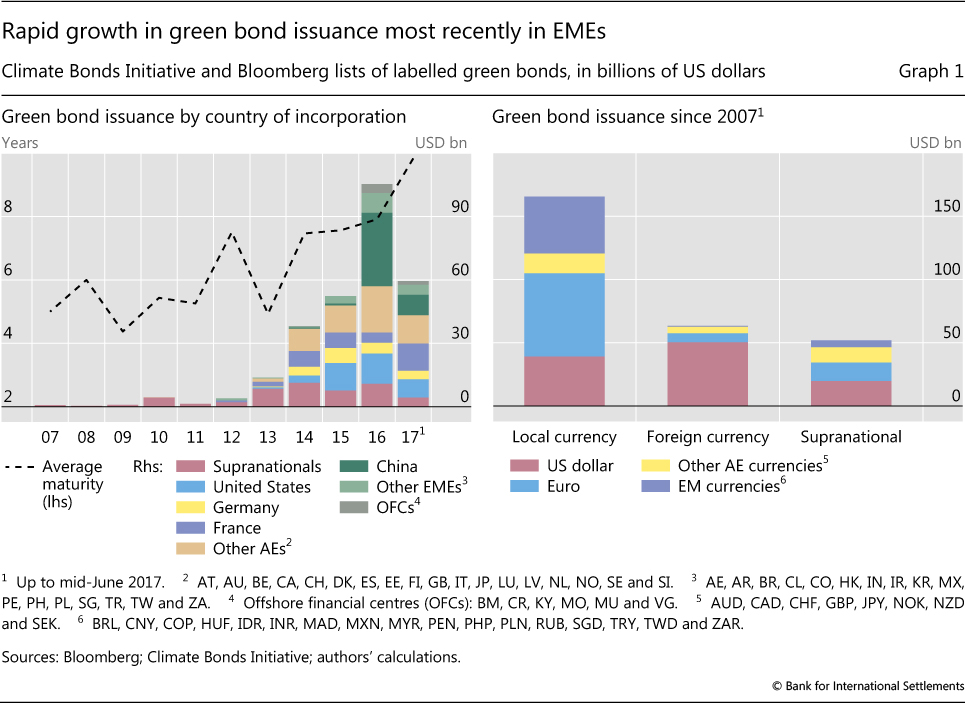

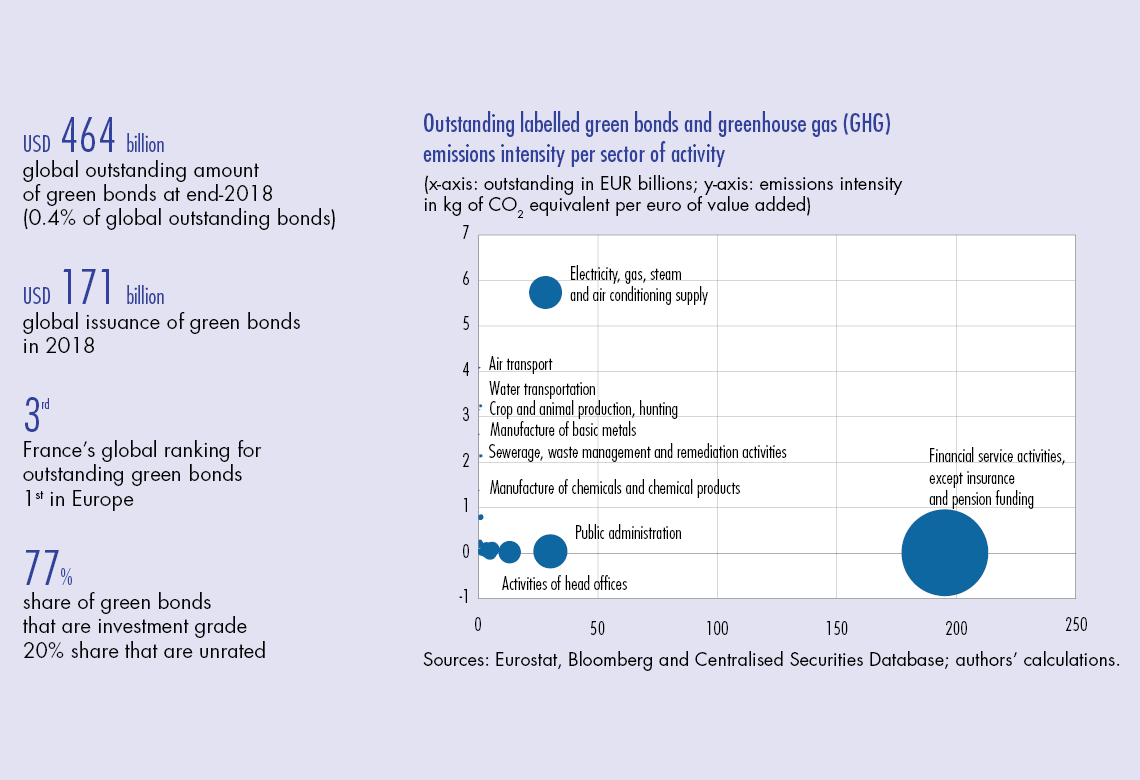

The green bond market is expanding rapidly but needs to be measured more accurately | Banque de France

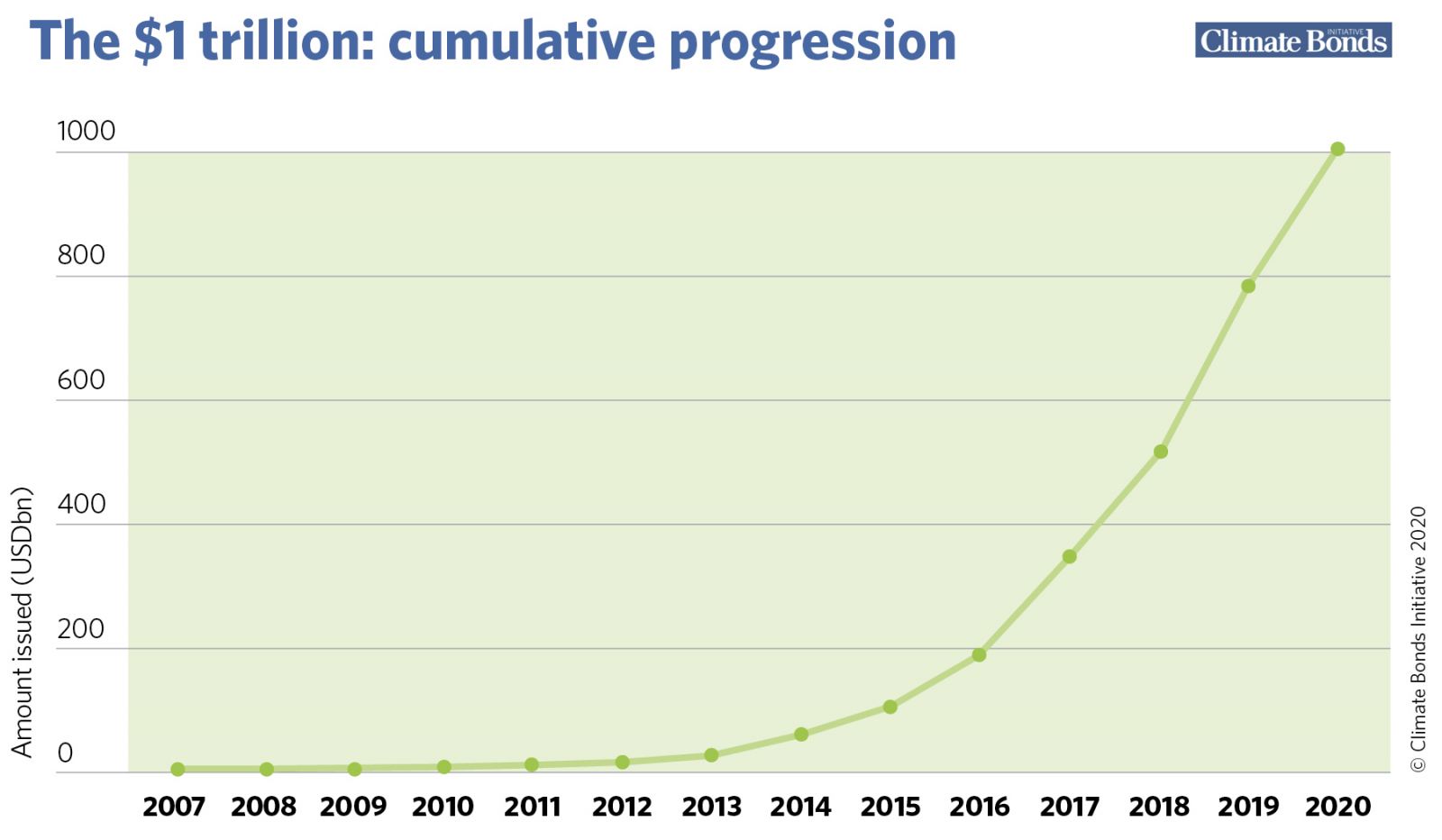

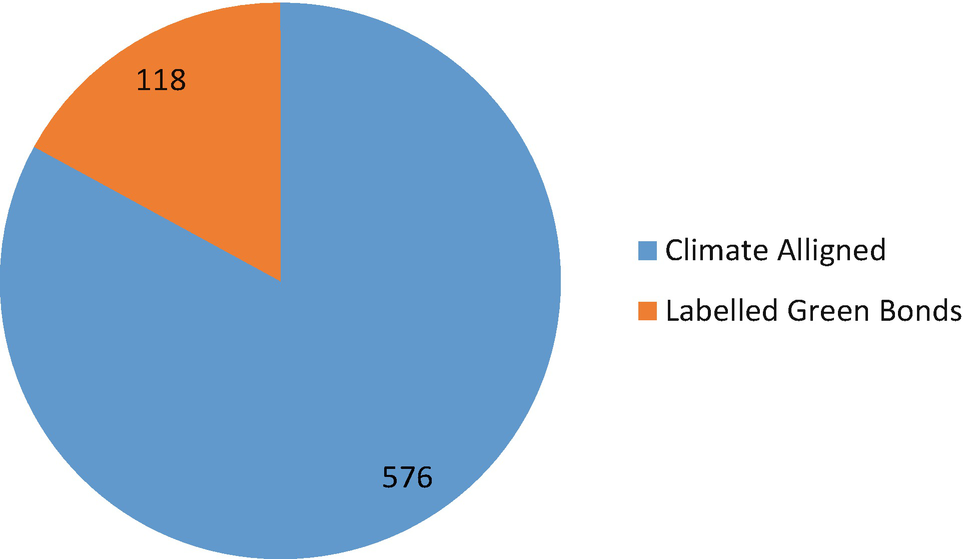

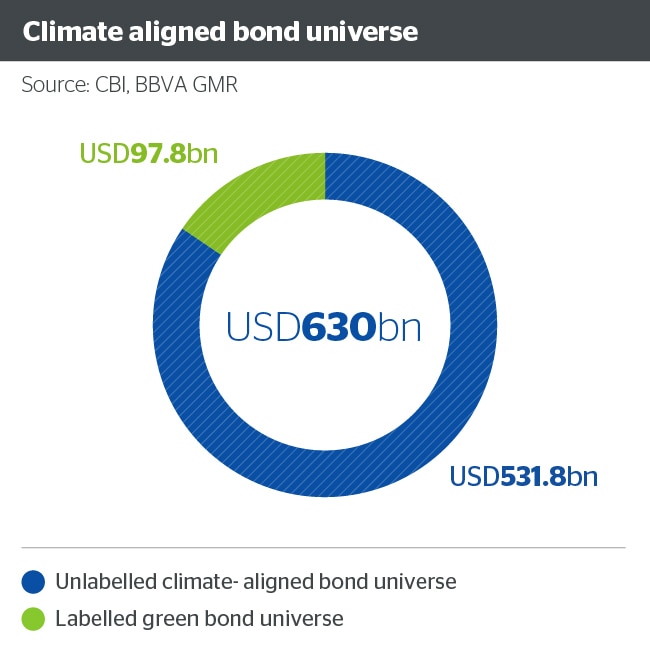

$1.45 tn of labelled green bonds and climate-aligned bonds leaves “headroom for huge growth” into 2020s – Jeremy Leggett

Green bonds: India becomes second-largest market for Green Bonds with $10.3 billion transactions, Energy News, ET EnergyWorld

China totalled USD44bn in labelled green bonds during 2020. Second largest country for green issuance

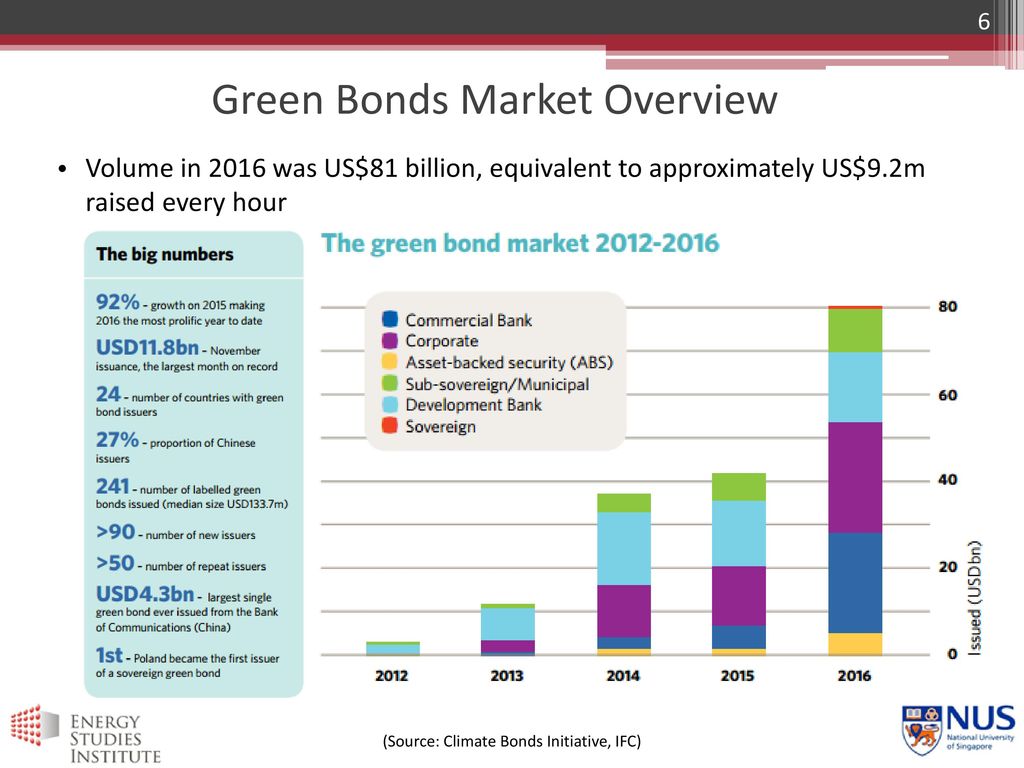

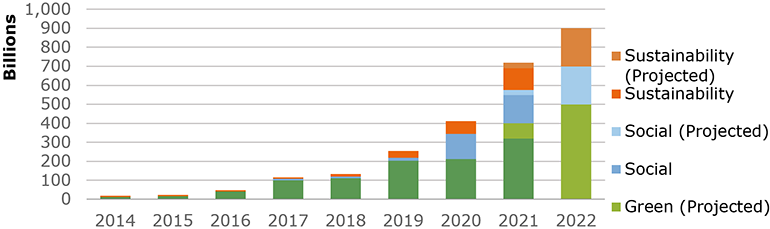

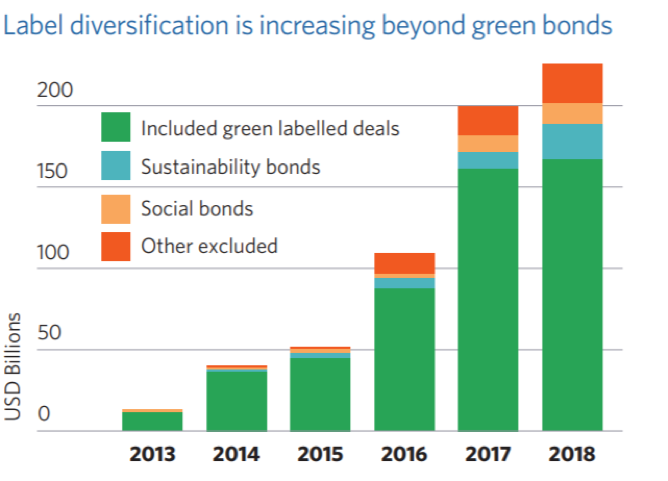

Climate Bonds launches Green bonds: The state of the market 2018 report at London Annual Conference | Climate Bonds Initiative

Climate Bonds launches Green bonds: The state of the market 2018 report at London Annual Conference | Climate Bonds Initiative